VAT Reconsideration

399,00 د.إ

- Easy way to apply penalty reduction

- We provide professional Arabic translator for your inquiry

- Professional Tax Advisor assist you on supporting documents preparing.

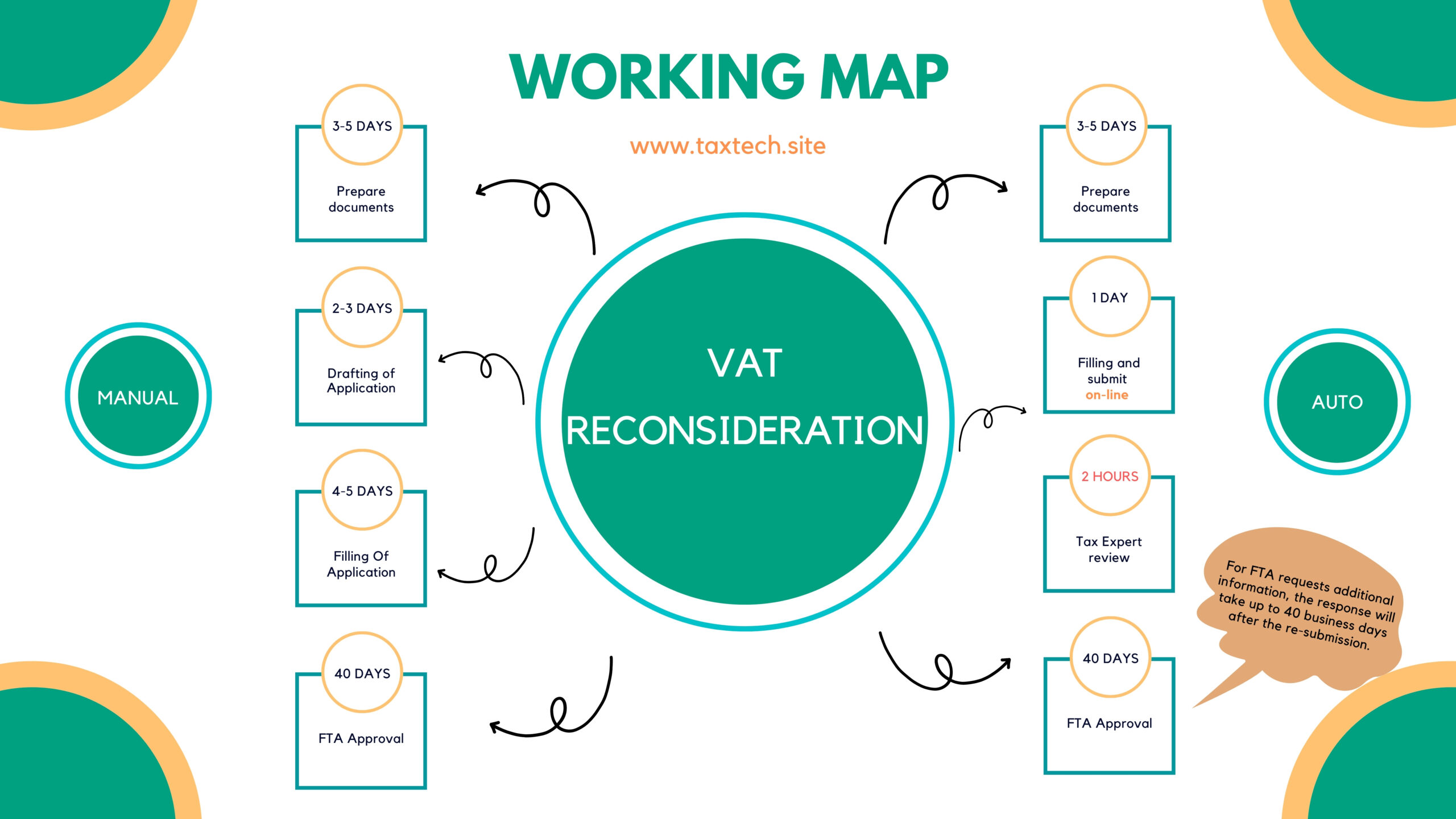

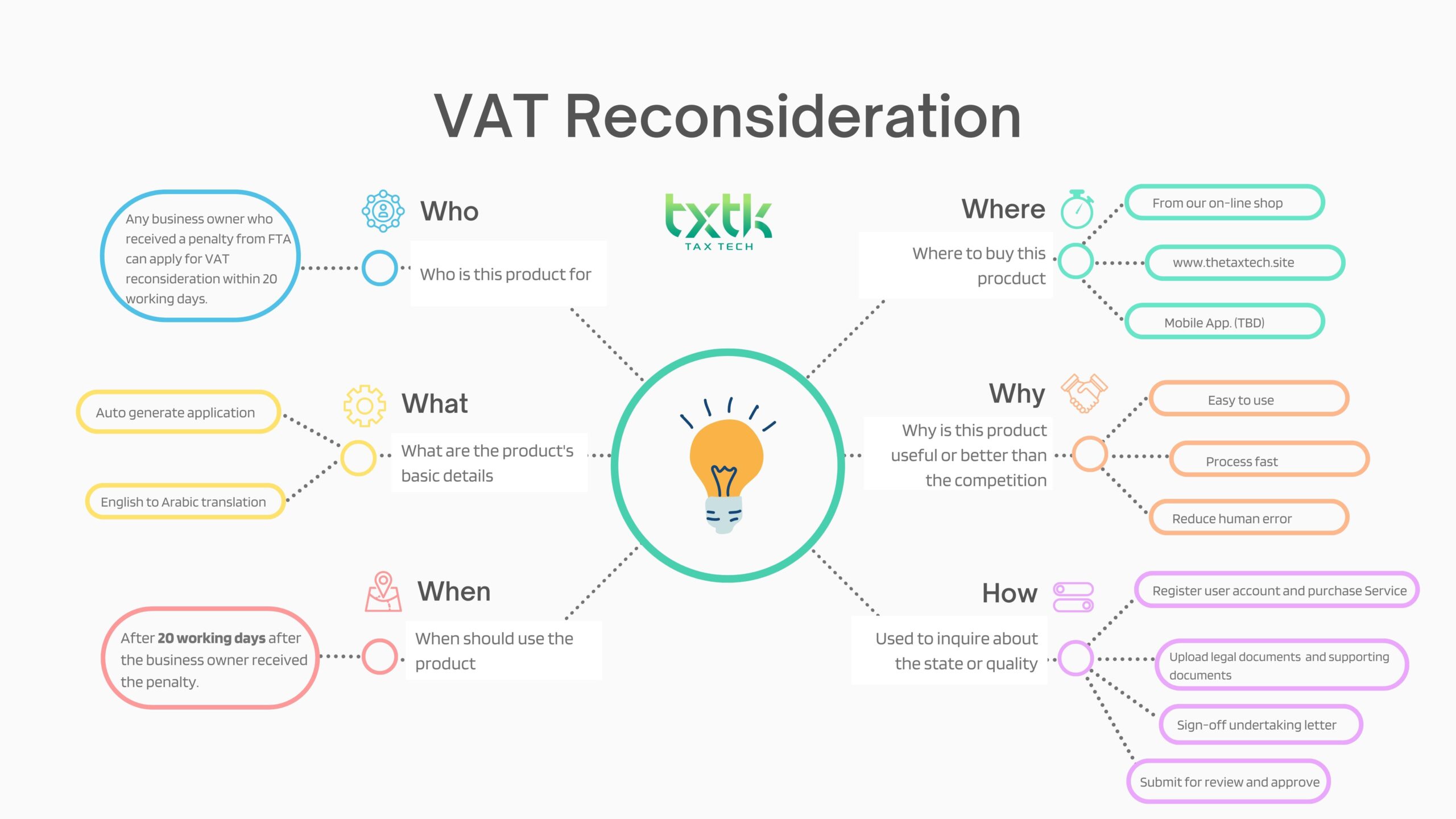

How to claim a VAT reconsideration in UAE for your business is sometimes difficult.

TXTK's strengths

- We has a wealth of local and international experience in assisting clients in how they can get prepared to obtain the requested VAT reconsideration with in a short timeframe.

- Provides automatic system, just upload all of supporting documents and TXTK will automatically review and submit for you.

That’s it. It couldn’t be any easier.

Required Documents:

- Emirates ID.

- Valid Passport.

- Penalty notification.

- Detailed letter on the incident.

- Supporting documents.

WHY YOU NEED

Reviews

There are no reviews yet.